Chapter 5 — The Expenditure Cycle Part I: Purchases and Cash Disbursements Procedures TRUE/FALSE 1. Purchasing decisions are authorized by inventory control. ANS: T 2.

The blind copy of the purchase order that goes to the receiving department contains no item descriptions. ANS: F 3. Firms that wish to improve control over cash disbursements use a voucher system. ANS: T 4.

In a voucher system, the sum of all unpaid vouchers in the voucher register equals the firm’s total voucher payable balance. ANS: T 5. The accounts payable department reconciles the accounts payable subsidiary ledger to the control

account. ANS: F 6. The use of inventory reorder points suggests the need to obtain specific authorization. ANS: F 7. Proper segregation of duties requires that the responsibility approving a payment be separated from

posting to the cash disbursements journal. ANS: T 8. A major risk exposure in the expenditure cycle is that accounts payable may be overstated at the end of the accounting year. ANS: F 9. When a trading partner agreement is in place, the traditional three way match may be eliminated.

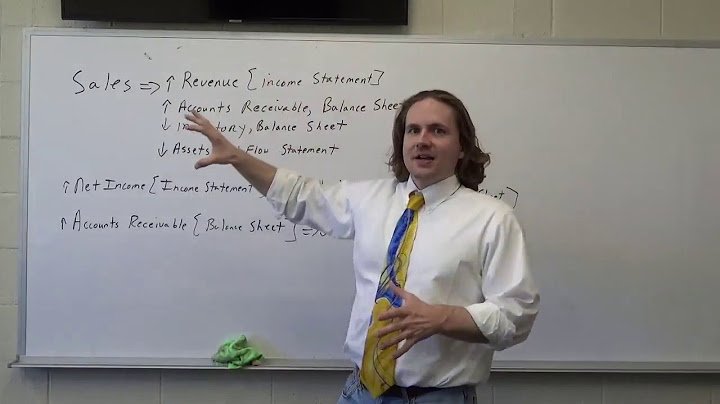

ANS: T 10. Authorization of purchases in a merchandising firm occurs in the inventory control department. ANS: T 11. A three way match involves a purchase order, a purchase requisition, and an invoice. What is a Cash Disbursement?A cash disbursement is the outflow of cash paid in exchange for the provision of goods or services. A cash disbursement can also be made to refund a customer,

which is recorded as a reduction of sales. Yet another type of cash disbursement is a dividend payment, which is recorded as a reduction in corporate equity. A cash disbursement can be made with bills or coins, a

check, or an electronic funds transfer. If a payment is made with a check, there is typically a delay of a few days before the funds are withdrawn from the company's checking account, due to the impact of mail float and

processing float. Cash disbursements are usually made through the accounts payable system, but funds can also be disbursed through the payroll system and through

petty cash. The cash disbursement process can be outsourced to a company's bank, which issues payments as of the dates authorized by the paying entity, using the funds in the entity's checking account. Successfully reported this slideshow. Your SlideShare is downloading. × Purchasing & cash disbursement

Purchasing & cash disbursement More Related Content- 1. C HAPTER 11 The Expenditure Cycle: Purchasing and Cash

Disbursements © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 1 of 122

- 2. INTRODUCTION • Questions to be addressed in this chapter include: – What are the basic business activities and data processing

operations that are performed in the expenditure cycle? – What decisions need to be made in the expenditure cycle, and what information is needed to make these decisions? – What are the major threats in the expenditure cycle and the controls related to those threats? © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 2 of 122

-

3. INTRODUCTION • The primary external exchange of information is with suppliers (vendors). • Information flows to the expenditure cycle from other cycles, e.g.: – The revenue cycle, production cycle, inventory control, and various departments provide

information about the need to purchase goods and materials. • Information also flows from the expenditure cycle: – When the goods and materials arrive, the expenditure cycle provides information about their receipt to the parties that have requested them. – Information is provided to the general ledger and reporting function for internal and external financial reporting. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 3 of 122

-

4. INTRODUCTION • The primary objective of the expenditure cycle is to minimize the total cost of acquiring and maintaining inventory, supplies, and services. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 4 of 122

- 5. INTRODUCTION • Decisions that must be made include: – What level of inventory and supplies should we carry? – What vendors provide the best price and quality? – Where should we store the goods? – Can we consolidate purchases across units? – How can

IT improve inbound logistics? – Is there enough cash to take advantage of early payment discounts? – How can we manage payments to maximize cash flow? © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 5 of 122

-

6. INTRODUCTION • Management also has to evaluate the efficiency and effectiveness of expenditure cycle processes. – These evaluations require data about: • Events that occur • Resources affected • Agents who participate – This data needs to be accurate,

reliable, and timely. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 6 of 122

- 7. INTRODUCTION • In this chapter, we’ll look at how the three basic AIS functions are carried out in the expenditure cycle: –

How do we capture and process data? – How do we store and organize the data for decisions? – How do we provide controls to safeguard resources (including data)? © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 7 of 122

-

8. EXPENDITURE CYCLE BUSINESS ACTIVITIES • The three basic activities performed in the expenditure cycle are: – Ordering goods, supplies, and services – Receiving and storing these items – Paying for these items • These activities mirror the activities in the

revenue cycle. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 8 of 122

- 9. EXPENDITURE CYCLE BUSINESS ACTIVITIES • The three basic activities performed in the expenditure cycle are: – Ordering goods,

supplies, and services – Receiving and storing these items – Paying for these items • These activities mirror the activities in the revenue cycle. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 9 of 122

-

10. ORDERING GOODS, SUPPLIES, AND SERVICES • Key decisions in this process involve identifying what, when, and how much to purchase and from whom. • Weaknesses in inventory control can create significant problems with this process: – Inaccurate records cause

shortages. • One of the key factors affecting this process is the inventory control method to be used. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 10 of 122

- 11. ORDERING GOODS, SUPPLIES, AND SERVICES •

Alternate Inventory Control Methods – We will consider three alternate approaches to inventory control: • Economic Order Quantity (EOQ) • Just in Time Inventory (JIT) • Materials Requirements Planning (MRP) © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 11 of 122

-

12. ORDERING GOODS, SUPPLIES, AND SERVICES • Alternate Inventory Control Methods – We will consider three alternate approaches to inventory control: • Economic Order Quantity (EOQ) • Materials Requirements Planning (MRP) • Just in Time Inventory (JIT) © 2006

Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 12 of 122

- 13. ORDERING GOODS, SUPPLIES, AND SERVICES • EOQ is the traditional approach to managing inventory. – Goal: Maintain enough stock so that production

doesn’t get interrupted. – Under this approach, an optimal order size is calculated by minimizing the sum of several costs: • Ordering costs • Carrying costs • Stockout costs – The EOQ formula is also used to calculate reorder point, i.e., the inventory level at which a new order should be placed. – Other, more recent approaches try to minimize or eliminate the amount of inventory carried. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 13 of 122

- 14. ORDERING GOODS, SUPPLIES, AND SERVICES • Alternate Inventory Control Methods – We will consider three alternate approaches to inventory control: • Economic Order Quantity (EOQ) • Materials Requirements Planning (MRP) • Just in Time Inventory (JIT) ©

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 14 of 122

- 15. ORDERING GOODS, SUPPLIES, AND SERVICES • MRP seeks to reduce inventory levels by improving the accuracy of forecasting techniques and carefully

scheduling production and purchasing around that forecast. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 15 of 122

- 16. ORDERING GOODS, SUPPLIES, AND SERVICES • Alternate Inventory Control Methods – We

will consider three alternate approaches to inventory control: • Economic Order Quantity (EOQ) • Materials Requirements Planning (MRP) • Just in Time Inventory (JIT) © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 16 of 122

-

17. ORDERING GOODS, SUPPLIES, AND SERVICES • JIT systems attempt to minimize or eliminate inventory by purchasing or producing only in response to actual (as opposed to forecasted) sales. • These systems have frequent, small deliveries of materials, parts, and

supplies directly to the location where production will occur. • A factory with a JIT system will have multiple receiving docks for their various work centers. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 17 of 122

-

18. ORDERING GOODS, SUPPLIES, AND SERVICES • Similarities and differences between MRP and JIT: – Scheduling production and inventory accumulation • MRP schedules production to meet estimated sales and creates a stock of finished goods inventory to be available

for those sales. • JIT schedules production in response to actual sales and virtually eliminates finished goods inventory, because goods are sold before they’re made. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 18 of 122

-

19. ORDERING GOODS, SUPPLIES, AND SERVICES • Similarities and differences between MRP and JIT: – Scheduling production and inventory accumulation – Nature of products • MRP systems are better suited for products that have predictable demand, such as consumer

staples. • JIT systems are particularly suited for products with relatively short life cycles (e.g., fashion items) and for which demand is difficult to predict. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 19 of 122

-

20. ORDERING GOODS, SUPPLIES, AND SERVICES • Similarities and differences between MRP and JIT: – Scheduling production and inventory accumulation – Nature of products – Costs and efficiency • Both can reduce costs and improve efficiency over traditional EOQ

approaches. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 20 of 122

- 21. ORDERING GOODS, SUPPLIES, AND SERVICES • Similarities and differences between MRP and JIT: – Scheduling production and inventory

accumulation – Nature of products – Costs and efficiency – Too much or too little • In either case, you must be able to: – Quickly accelerate production if there is unanticipated demand – Quickly stop production if too much inventory is accumulating. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 21 of 122

-

22. ORDERING GOODS, SUPPLIES, AND SERVICES • Whatever the inventory control system, the order processing typically begins with a purchase request followed by the generation of a purchase order. • A request to purchase goods or supplies is triggered by either:

– The inventory control function; or – An employee noticing a shortage. • Advanced inventory control systems automatically initiate purchase requests when quantity falls below the reorder point. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 22 of 122

-

23. ORDERING GOODS, SUPPLIES, AND SERVICES • The need to purchase goods typically results in the creation of a purchase requisition. The purchase requisition is a paper document or electronic form that identifies: – Who is requesting the goods – Where they

should be delivered – When they’re needed – Item numbers, descriptions, quantities, and prices – Possibly a suggested supplier – Department number and account number to be charged • Most of the detail on the suppliers and the items purchased can be pulled from the supplier and inventory master files. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 23 of 122

-

24. ORDERING GOODS, SUPPLIES, AND SERVICES • The purchase requisition is received by a purchasing agent (aka, buyer) in the purchasing department, who typically performs the purchasing activity. – In manufacturing companies, this function usually reports to

the VP of Manufacturing. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 24 of 122

- 25. ORDERING GOODS, SUPPLIES, AND SERVICES • A crucial decision is the selection of supplier. • Key considerations are: –

Price – Quality – Dependability • Especially important in JIT systems because late or defective deliveries can bring the whole system to a halt. • Consequently, certification that suppliers meet ISO 9000 quality standards is important. This certification recognizes that the supplier has adequate quality control processes. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 25 of 122

-

26. ORDERING GOODS, SUPPLIES, AND SERVICES • Once a supplier has been selected for a product, their identity should become part of the product inventory master file so that the selection process does not have to be carried out for every purchase. – A list of

potential alternates should also be maintained. – For products that are seldom ordered, the selection process may be repeated every time. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 26 of 122

- 27.

ORDERING GOODS, SUPPLIES, AND SERVICES • It’s important to track and periodically evaluate supplier performance, including data on: – Purchase prices – Rework and scrap costs – Supplier delivery performance • The purchasing function should be evaluated and rewarded based on how well it minimizes total costs, not just the costs of purchasing the goods. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 27 of 122

-

28. ORDERING GOODS, SUPPLIES, AND SERVICES • A purchase order is a document or electronic form that formally requests a supplier to sell and deliver specified products at specified prices. • The PO is both a contract and a promise to pay. It includes: – Names of

supplier and purchasing agent – Order and requested delivery dates – Delivery location – Shipping method – Details of the items ordered © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 28 of 122

- 29.

ORDERING GOODS, SUPPLIES, AND SERVICES • Multiple purchase orders may be completed for one purchase requisition if multiple vendors will fill the request. • The ordered quantity may also differ from the requested quantity to take advantage of quantity discounts. • A blanket order is a commitment to buy specified items at specified prices from a particular supplier for a set time period. – Reduces buyer’s uncertainty about reliable material sources – Helps supplier plan capacity and operations ©

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 29 of 122

- 30. ORDERING GOODS, SUPPLIES, AND SERVICES • IT can help improve efficiency and effectiveness of purchasing function. – The major cost driver is the

number of purchase orders processed. Time and cost can be cut by: • Using EDI to transmit purchase orders © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 30 of 122

- 31. ORDERING GOODS, SUPPLIES, AND

SERVICES • In a vendor-managed inventory (VMI) program: • IT can help improve efficiency and effectiveness of purchasing function. – Inventory control and purchasing are outsourced to a supplier – The supplier has access to POS and inventory data and automatically replenishes inventory – The major cost driver is the number of – This approach: purchase • orders Reduces amount processed. of inventory carried Time and cost can be • Eliminates cut by: costs of generating purchase orders – Requires

good controls to ensure accuracy of inventory records • Using EDI to transmit purchase orders • Using vendor-managed inventory systems © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 31 of 122

- 32. ORDERING

GOODS, SUPPLIES, AND SERVICES • IT can help improve efficiency and effectiveness of purchasing function. – The major cost driver is the number of purchase orders processed. Time and cost can be cut by: • Suppliers compete with each other to meet demand at the lowest price • Best suited to commodities, rather than critical • Using EDI to transmit purchase orders • Using vendor-managed inventory systems • Reverse auctions components, where quality, vendor reliability, and delivery performance are

not crucial © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 32 of 122

- 33. ORDERING GOODS, SUPPLIES, AND SERVICES • IT can help improve efficiency and effectiveness of purchasing function. – The major cost

driver is the number of purchase orders processed. Time and cost can be cut by: • Used for large purchases that involve formal bids • Internal auditor visits each potential supplier in final • Using EDI to transmit purchase orders • Using cut vendor-to verify managed accuracy of inventory their bid systems • Reverse auctions • Pre-award audits • May identify mathematical errors in bid which can produce considerable savings © 2006 Prentice Hall Business Publishing Accounting Information Systems,

10/e Romney/Steinbart 33 of 122

- 34. ORDERING GOODS, SUPPLIES, AND SERVICES • IT can help improve efficiency and effectiveness of purchasing function. – The major cost driver is the number of purchase orders processed. Time and cost can be cut here by:

• A corporate credit card can be used with specific • Using EDI to transmit purchase orders suppliers for specific types of purchases • Using vendor-managed inventory systems • Reverse auctions • Pre-award audits • Procurement cards for small purchases • Spending limits can be set • Account numbers on cards can be mapped to general ledger accounts © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 34 of 122

-

35. EXPENDITURE CYCLE BUSINESS ACTIVITIES • The three basic activities performed in the expenditure cycle are: – Ordering goods, supplies, and services – Receiving and storing these items – Paying for these items • These activities mirror the activities in the

revenue cycle. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 35 of 122

- 36. RECEIVING AND STORING GOODS • The receiving department accepts deliveries from suppliers. – Normally reports to warehouse

manager, who reports to VP of Manufacturing. • Inventory stores typically stores the goods. – Also reports to warehouse manager. • The receipt of goods must be communicated to the inventory control function to update inventory records. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 36 of 122

-

37. RECEIVING AND STORING GOODS • The two major responsibilities of the receiving department are: – Deciding whether to accept delivery – Verifying the quantity and quality of delivered goods • The first decision is based on whether there is a valid purchase

order. – Accepting un-ordered goods wastes time, handling and storage. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 37 of 122

- 38. RECEIVING AND STORING GOODS • Verifying the quantity of delivered goods

is important so: – The company only pays for goods received – Inventory records are updated accurately • The receiving report is the primary document used in this process: – It documents the date goods received, shipper, supplier, and PO number – Shows item number, description, unit of measure, and quantity for each item – Provides space for signature and comments by the person who received and inspected • Receipt of services is typically documented by supervisory approval of the supplier’s

invoice. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 38 of 122

- 39. RECEIVING AND STORING GOODS • When goods arrive, a receiving clerk compares the PO number on the packing slip with the open PO file

to verify the goods were ordered. – Then counts the goods – Examines for damage before routing to warehouse or factory • Three possible exceptions in this process: – The quantity of goods is different from the amount ordered – The goods are damaged – The goods are of inferior quality © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 39 of 122

-

40. RECEIVING AND STORING GOODS • If one of these exceptions occurs, the purchasing agent resolves the situation with the supplier. – Supplier typically allows adjustment to the invoice for quantity discrepancies. – If goods are damaged or inferior, a debit

memo is prepared after the supplier agrees to accept a return or grant a discount. • One copy goes to supplier, who returns a credit memo in acknowledgment. • One copy to accounts payable to adjust the account payable. • One copy to shipping to be returned to supplier with the actual goods. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 40 of 122

-

41. RECEIVING AND STORING GOODS • IT can help improve the efficiency and effectiveness of the receiving activity: – Bar-coding • Requiring suppliers to bar-code products speeds the counting process and improves accuracy. © 2006 Prentice Hall Business

Publishing Accounting Information Systems, 10/e Romney/Steinbart 41 of 122

- 42. RECEIVING AND STORING GOODS • IT can help improve the efficiency and effectiveness of the receiving activity: – Bar-coding – RFID • Passive radio frequency identification

(RFID) tags eliminate the need to scan bar codes. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 42 of 122

- 43. RECEIVING AND STORING GOODS • IT can help improve the efficiency and effectiveness of the

receiving activity: – Bar-coding – RFID – EDI and satellite technology • EDI and satellite technology make it possible to track the exact location of incoming shipments and have receiving staff on hand to unload trucks. • Also enables drivers to be directed to specific loading docks where goods will be used. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 43 of 122

-

44. RECEIVING AND STORING GOODS • IT can help improve the efficiency and effectiveness of the receiving activity: – Bar-coding – RFID – EDI and satellite technology – Audits • Audits can identify opportunities to cut freight costs and can ensure that suppliers

are not billing for transportation costs they are supposed to assume. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 44 of 122

- 45. EXPENDITURE CYCLE BUSINESS ACTIVITIES • The three basic activities

performed in the expenditure cycle are: – Ordering goods, supplies, and services – Receiving and storing these items – Paying for these items • These activities mirror the activities in the revenue cycle. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 45 of 122

-

46. PAYING FOR GOODS AND SERVICES • There are two basic sub-processes involved in the payment process: – Approval of vendor invoices – Actual payment of the invoices © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart

46 of 122

- 47. PAYING FOR GOODS AND SERVICES • There are two basic sub-processes involved in the payment process: – Approval of vendor invoices – Actual payment of the invoices © 2006 Prentice Hall Business Publishing Accounting Information Systems,

10/e Romney/Steinbart 47 of 122

- 48. PAYING FOR GOODS AND SERVICES • Approval of vendor invoices is done by the accounts payable department, which reports to the controller. • The legal obligation to pay arises when goods are received. – But most

companies pay only after receiving and approving the invoice. – This timing difference may necessitate adjusting entries at the end of a fiscal period. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 48 of 122

-

49. PAYING FOR GOODS AND SERVICES • Objective of accounts payable: – Authorize payment only for goods and services that were ordered and actually received. • Requires information from: – Purchasing—about existence of valid purchase order – Receiving—for

receiving report indicating goods were received © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 49 of 122

- 50. PAYING FOR GOODS AND SERVICES • There are two basic approaches to processing vendor invoices: –

Non-voucher system • Each invoice is stored in an open invoice file. • When a check is written, the invoice is marked “paid” and then stored in a paid invoice file. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 50 of 122

-

51. PAYING FOR GOODS AND SERVICES • There are two basic approaches to processing vendor invoices: – Non-voucher system – Voucher system • A disbursement voucher is prepared which lists: – Outstanding invoices for the supplier – Net amount to be paid after

discounts and allowances • The disbursement voucher effectively shows which accounts will be debited and credited, along with the account numbers. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 51 of 122

-

52. PAYING FOR GOODS AND SERVICES • There are two basic approaches to processing vendor invoices: – Non-voucher system – Voucher system • Advantages of a voucher system: – Several invoices may be paid at once, which reduces number of checks written – Vouchers

can be pre-numbered which simplifies the audit trail for payables – Invoice approval is separated from invoice payment, which makes it easier to schedule both to maximize efficiency © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 52 of 122

-

53. PAYING FOR GOODS AND SERVICES • There are two basic sub-processes involved in the payment process: – Approval of vendor invoices – Actual payment of the invoices © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart

53 of 122

- 54. PAYING FOR GOODS AND SERVICES • Payment of the invoices is done by the cashier, who reports to the treasurer. • The cashier receives a voucher package, which consists of the vendor invoice and supporting documentation, such as purchase

order and receiving report. • This voucher package authorizes issuance of a check or EFT to the supplier. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 54 of 122

- 55. PAYING FOR GOODS AND SERVICES •

Referred to as Evaluated Receipt Settlement. • Payments are issued based on what is ordered and • Processing efficiency can be improved by: received. • Requires that: – Requiring suppliers to submit invoices by EDI – Having the system automatically match invoices to POs and receiving reports – Eliminating vendor invoices – Suppliers quote accurate prices when orders are placed. – Receiving personnel count accurately and inspect merchandise received. • Typically incorporates very timely

communications about shipments and receipts. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 55 of 122

- 56. PAYING FOR GOODS AND SERVICES • Processing efficiency can be improved by: – Requiring suppliers to

submit invoices by EDI – Having the system automatically match invoices to POs and receiving reports – Eliminating vendor invoices – Using procurement cards for non-inventory purchases © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 56 of 122

-

57. PAYING FOR GOODS AND SERVICES • Processing efficiency can be improved by: – Requiring suppliers to submit invoices by EDI – Having the system automatically match invoices to POs and receiving reports – Eliminating vendor invoices – Using procurement cards

for non-inventory purchases – Using company credit cards and electronic forms for travel expenses © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 57 of 122

- 58. PAYING FOR GOODS AND SERVICES • Processing

efficiency can be improved by: – Requiring suppliers to submit invoices by EDI – Having the system automatically match invoices to POs and receiving reports – Eliminating vendor invoices – Using procurement cards for non-inventory purchases – Using company credit cards and electronic forms for travel expenses – Preparing careful cash budgets to take advantage of early-payment discounts © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 58 of 122

- 59. PAYING FOR GOODS AND SERVICES • Processing efficiency can be improved by: – Requiring suppliers to submit invoices by EDI – Having the system automatically match invoices to POs and receiving reports – Eliminating vendor invoices – Using procurement

cards for non-inventory purchases – Using company credit cards and electronic forms for travel expenses – Preparing careful cash budgets to take advantage of early-payment discounts – Using FEDI to pay suppliers © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 59 of 122

-

60. REVIEW OF EXPENDITURE CYCLE ACTIVITIES • Before we move on to discuss internal controls in the expenditure cycle, let’s do a brief review of the organization chart, including: – Who does what in the expenditure cycle – To whom they typically report © 2006

Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 60 of 122

- 61. PARTIAL ORGANIZATION CHART FOR UNITS INVOLVED IN EXPENDITURE CYCLE VP of Manufacturing CEO Purchasing Receiving Inventory Stores Controller Accounts

Payable Treasurer Cashier CFO • Selects suitable suppliers • Issues purchase orders © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 61 of 122

- 62. PARTIAL ORGANIZATION CHART FOR UNITS INVOLVED IN

EXPENDITURE CYCLE VP of Manufacturing CEO Purchasing Receiving Inventory Stores Controller Accounts Payable Treasurer Cashier CFO • Decides whether to accept deliveries • Counts and inspects deliveries © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 62 of 122

-

63. PARTIAL ORGANIZATION CHART FOR UNITS INVOLVED IN EXPENDITURE CYCLE VP of Manufacturing CEO Purchasing Receiving Inventory Stores CFO Controller Accounts Payable Treasurer Cashier • Stores goods that have been delivered and accepted © 2006 Prentice Hall

Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 63 of 122

- 64. PARTIAL ORGANIZATION CHART FOR UNITS INVOLVED IN EXPENDITURE CYCLE VP of Manufacturing CEO Purchasing Receiving Inventory Stores Controller Accounts Payable

Treasurer Cashier CFO • Approves invoices for payment © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 64 of 122

- 65. PARTIAL ORGANIZATION CHART FOR UNITS INVOLVED IN EXPENDITURE CYCLE VP of Manufacturing

CEO Purchasing Receiving Inventory Stores CFO Controller Accounts Payable Treasurer Cashier • Issues payment to vendors © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 65 of 122

- 66. CONTROL: OBJECTIVES,

THREATS, AND PROCEDURES • In the expenditure cycle (or any cycle), a well-designed AIS should provide adequate controls to ensure that the following objectives are met: – All transactions are properly authorized – All recorded transactions are valid – All valid and authorized transactions are recorded – All transactions are recorded accurately – Assets are safeguarded from loss or theft – Business activities are performed efficiently and effectively – The company is in compliance with all

applicable laws and regulations – All disclosures are full and fair © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 66 of 122

- 67. CONTROL: OBJECTIVES, THREATS, AND PROCEDURES • There are several actions a

company can take with respect to any cycle to reduce threats of errors or irregularities. These include: – Using simple, easy-to-complete documents with clear instructions (enhances accuracy and reliability). – Using appropriate application controls, such as validity checks and field checks (enhances accuracy and reliability). – Providing space on forms to record who completed and who reviewed the form (encourages proper authorizations and accountability). © 2006 Prentice Hall Business

Publishing Accounting Information Systems, 10/e Romney/Steinbart 67 of 122

- 68. CONTROL: OBJECTIVES, THREATS, AND PROCEDURES – Pre-numbering documents (encourages recording of valid and only valid transactions). – Restricting access to blank documents

(reduces risk of unauthorized transaction). • In the following sections, we’ll discuss the threats that may arise in the three major steps of the expenditure cycle, as well as general threats, EDI-related threats, and threats related to purchases of services. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 68 of 122

-

69. CRIME TIME • Before we discuss specific threats, it may be helpful to have some background on a form of occupational fraud and abuse which is broadly referred to as corruption. • Corruption cases often involve arrangements between a company’s purchasing

agent and a sales representative for one of the company’s vendors. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 69 of 122

- 70. CRIME TIME • The vendor’s representative may try to induce the purchasing

agent to buy goods that: – Are over-priced – Are of inferior quality – Aren’t even needed – Aren’t even delivered • In exchange, the vendor’s rep typically offers the purchasing agent something of value. That “something” might be money, payment of a debt, a job offer, an expensive vacation, or anything the purchasing agent might value. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 70 of 122

- 71. CRIME TIME • According to the Fraud Examiner’s Manual published by the Association of Certified Fraud Examiners, these schemes usually take four forms: – Bribery • Typically involves the vendor offering a kickback (something of value) to the buyer to buy inflated, substandard, un-needed, or un-delivered

goods, etc. • Alternately, may involve an inducement to the buyer to rig a competitive bidding process so that the vendor gets the bid. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 71 of 122

- 72. CRIME

TIME • According to the Fraud Examiner’s Manual published by the Association of Certified Fraud Examiners, these schemes usually take four forms: – Bribery – Conflict of interest • In conflict of interest cases, the purchasing agent is usually arranging for his employer to make purchases from a company in which he has a concealed interest. • For example, perhaps his wife owns the vendor company. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 72 of

122

- 73. CRIME TIME • According to the Fraud Examiner’s Manual published by the Association of Certified Fraud Examiners, these schemes usually take four forms: • Economic extortion is basically the reverse of a bribe. • Instead of the vendor making an

offer of something of value to the purchasing agent, the purchasing agent may tell the vendor that he must provide something of value to the purchasing agent if he wants to continue to do business with his employer. – Bribery – Conflict of interest – Economic extortion © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 73 of 122

-

74. CRIME TIME • According to the Fraud Examiner’s Manual published by the Association of Certified Fraud Examiners, these schemes usually take four forms: • Illegal gratuities involve gifts that are given to the purchasing agent by a vendor after the vendor

has been selected. – Bribery – Conflict of interest – Economic extortion – Illegal gratuities • There was no intent by the vendor to influence the selection process; the gift was provided after the fact. • But the problem is that the gift is too likely to impact future decisions by the purchasing agent. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 74 of 122

-

75. CRIME TIME • According to the Fraud Examiner’s Manual published by the Association of Certified Fraud Examiners, these schemes usually take four forms: – Bribery – Conflict of interest – Economic extortion – Illegal gratuities • How do you think these

activities relate to the Foreign Corrupt Practices Act? © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 75 of 122

- 76. • You can click on any of the threats below to get more information on: – The types of

problems posed by each threat – The controls that can mitigate the threats. THREATS IN ORDERING GOODS • Threats in the process of ordering goods include: – THREAT 1: Stockouts and/or Excess Inventory – THREAT 2: Ordering Unnecessary Items – THREAT 3: Purchasing Goods at Inflated Prices – THREAT 4: Purchasing Goods of Inferior Quality – THREAT 5: Purchasing from Unauthorized Suppliers – THREAT 6: Kickbacks – EDI-Related Threats – Threats Related to Purchases of Services © 2006 Prentice Hall

Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 76 of 122

- 77. THREATS IN RECEIVING AND STORING GOODS • The primary objectives of this process are to: – Verify the receipt of ordered inventory – Safeguard the inventory against

loss or theft • Threats in the process of receiving and storing goods include: – THREAT 7: Receiving unordered goods – THREAT 8: Errors in counting received goods – THREAT 9: Theft of inventory • You can click on any of the threats above to get more information on: – The types of problems posed by each threat – The controls that can mitigate the threats. © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 92 of 122

-

78. • You can click on any of the threats below to get THREATS IN APPROVING AND PAYING VENDOR INVOICES more information on: – The types of problems posed by each threat – The controls that can mitigate the threats. • The primary objectives of this process are

to: – Pay only for goods and services that were ordered and received – Safeguard cash • Threats in the process of approving and paying vendor invoices include: – THREAT 10: Failing to catch errors in vendor invoices – THREAT 11: Paying for goods not received – THREAT 12: Failing to take available purchase discounts – THREAT 13: Paying the same invoice twice – THREAT 14: Recording and posting errors to accounts payable – THREAT 15: Misappropriating cash, checks, or EFTs © 2006 Prentice Hall

Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 98 of 122

- 79. GENERAL CONTROL ISSUES • You can click on any of the threats below to get more information on: – The types of problems posed by each threat – The controls that can

mitigate the threats. • Two general objectives pertain to activities in every cycle: – Accurate data should be available when needed – Activities should be performed efficiently and effectively • The related general threats are: – THREAT 16: Loss, Alteration, or Unauthorized Disclosure of Data – THREAT 17: Poor performance © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 111 of 122

-

80. EXPENDITURE CYCLE INFORMATION NEEDS • Information is needed for the following operational tasks in the expenditure cycle, including: – Deciding when and how much inventory to order – Deciding on appropriate suppliers – Determining if vendor invoices are

accurate – Deciding whether to take purchase discounts – Determining whether adequate cash is available to meet current obligations © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 116 of 122

- 81.

EXPENDITURE CYCLE INFORMATION NEEDS • Information is also needed for the following strategic decisions: – Setting prices for products/services – Establishing policies on returns and warranties – Deciding on credit terms – Determining short-term borrowing needs – Planning new marketing campaigns © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 117 of 122

- 82. EXPENDITURE CYCLE INFORMATION NEEDS • The AIS needs to provide information to evaluate the following: – Purchasing efficiency and effectiveness – Supplier performance – Time taken to move goods from receiving to production – Percent of purchase discounts taken • Both financial and operating information are needed to manage and evaluate these

activities • Both external and internal information are needed © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 118 of 122

- 83. EXPENDITURE CYCLE INFORMATION NEEDS • When the AIS integrates information from

the various cycles, sources, and types, the reports that can be generated are unlimited. They include reports on: – Supplier performance – Outstanding invoices – Performance of expenditure cycle employees – Number of POs processed by purchasing agent – Number of invoices processed by A/P clerk – Number of deliveries handled by receiving clerk © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 119 of 122

-

84. EXPENDITURE CYCLE INFORMATION NEEDS – Number of inventory moves by warehouse worker – Inventory turnover – Classification of inventory based on contribution to profitability • Accountants should continually refine and improve these performance reports ©

2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 120 of 122

- 85. SUMMARY • You’ve learned about the basic business activities and data processing operations that are performed in the expenditure cycle,

including: – Ordering goods, supplies, and services – Receiving and storing them – Approving invoices and paying for them • You’ve learned how IT can improve the efficiency and effectiveness of these processes © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 121 of 122

-

86. SUMMARY • You’ve learned about decisions that need to be made in the expenditure cycle and what information is required to make these decisions • You’ve also learned about the major threats that present themselves in the expenditure cycle and the controls

that can mitigate those threats © 2006 Prentice Hall Business Publishing Accounting Information Systems, 10/e Romney/Steinbart 122 of 122

What are the three important controls over cash disbursements?

5 Important Internal Controls for Cash Disbursements. Segregate duties. The foundation of a good internal control system is segregation of duties. ... . Review authorized signors. ... . Consider requiring dual signatures. ... . Remember the wire transfers. ... . Reconcile bank accounts in a timely manner.. What internal controls are needed for cash disbursement?

What Internal Controls Are Needed for Cash Disbursement?. Segregation of Duties. Segregation of duties means that no financial transaction is handled by only one person from beginning to end. ... . Authorization and Processing of Disbursements. ... . Managing Restricted Funds. ... . Check Signing. ... . Internal Accounting Controls Checklist.. What are the steps taken in the cash disbursement system?

These steps include vendor account reconciliation, cash management techniques, and payment authorization. Cash management is the careful oversight of cash balances, forecasted cash payments, and forecasted cash receipts to insure that adequate cash balances exist to meet obligations.

What is purchase and cash disbursement?

The cash disbursement cycle is the process by which a business buys items, from parts for a manufacturing process to goods for commercial sale, with cash resources. This process relies heavily on the decisions and approval of the accounting department of a company.

|